Selling your product or services online is a must, even if your primary product or service is purchased in person. There are approximately 2.14 billion global online shoppers ¼ of the world’s population.

If you don’t accept payments online you are definitely leaving money on the table!

Bear in mind that accepting online payments for your goods or services helps you reach a wider audience and keep the customer experience running smoothly. Together we will break down the easiest and fastest ways to accept payments online.

Remember: Even though there’s no way to escape some transaction and currency fees - you can sell worldwide, keep open horizons- there are ways to reduce processing and clearing costs and receive payments for free!

Best ways to accept online payments

- Credit and Debit Cards

- Payment Gateways

- Mobile Payments

- Payment links

Let’s dig into them…

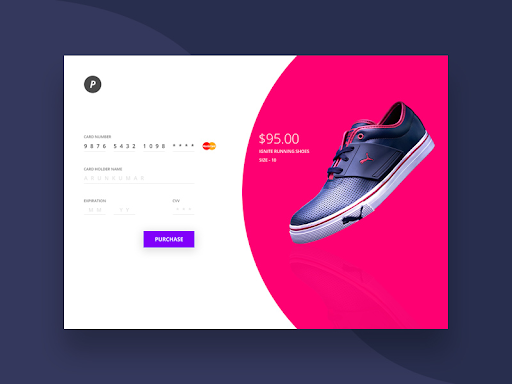

Credit and Debit Cards

Almost 70% of the United States population carries a credit card with the ⅓ of them using 3 or more credit cards during a regular week.

No matter what business you own, accepting credit and debit cards should be on top of your thoughts when it comes to payments.

But an important thing to keep in mind is that accepting debit or credit cards requires a merchant account.Good news though, if you are a brick-and-mortar shop going online, you already have a merchant account with the bank you are using.

Merchant account or CC processing is a type of bank account which enables you to accept online payments.

Just to have an underlying understanding of the processes used in a merchant account:

- Customer makes the purchase

- Merchant account checks funds availability

- Transaction is verified by card company (MasterCard, Visa)

- Money enters your bank account

Usually, the funds arrive with a delay of 2 business days, while payment is verified, authorized and deemed secure.

Things to remember:

✔️Merchant account is a bank account, so you can connect it to

your website as you can with any other bank account.

✔️ You can easily open a merchant account at almost any bank

($10-30 flat fee per month)

✔️Credit Cards you can accept: VISA, MasterCard and American

Express

Payment Gateways

In plain English, a payment gateway connects your website to a checkout. Either embedding a checkout on your website or redirecting customers to the payment gateway’s own website, these software link your website to Visa, MasterCard and American Express.

Stripe

Stripe is the most popular Payment Gateway. It is both a payment gateway and merchant account, as well as a subscription management platform.

Advantages:

✔️Multiple Integrations (including Pricewell)

✔️Pricing is fairly friendly for new SaaS companies

✔️All-in-one solution

Disadvantages:

❌Scaling can make the fees to add up

❌Setting up can become confusing

❌Add-on services can make pricing expensive

Stripe Fees

Monthly feeSetup feeOnline transaction feeStripe Billing costs

Braintree

Braintree is a service owned by Paypal -and a Stripe alternative for most SaaS companies-

Similar to Stripe, Braintree is a payment gateway, merchant account, and subscription management platform.

The greatest advantage of using Braintree, as a Paypal subsidiary, is the added benefit of being able to offer Paypal for payments.

Advantages:

✔️Cheaper than Stripe (1.9% vs, 2.9% +$0.30)

✔️Extended availability (45+ countries geographical reach)

✔️Accept Paypal Payments

✔️Integration with existing merchant accounts

Disadvantages:

❌Favors one-off transactions v.s. recurring payments

❌Subscription Analytics needed

❌Difficult to set up

Braintree Fees

Monthly feeSetup feeOnline transaction feeInvoice Costs:

Ideal Fit

Braintree is good for international SaaS companies, or the ones who want to accept Paypal payments. Just a great, cheaper alternative to Stripe.

There are hundreds of payment gateways out there, with unique features and offerings to meet the most challenging demand.We presented just two of them here.In more detail you can see our Best Payment Gateways article here

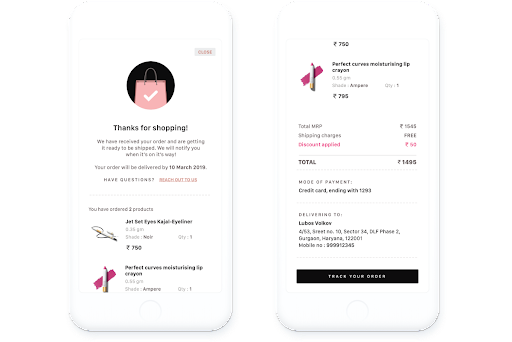

Mobile Payments

In 2009 Peter Thiel expressed it as vividly as possible when he predicted that in 5 years time people will pay using only their phones and an appropriate form of currency.Indeed mobile wallets like Apple Pay, Google Pay, Samsung Pay and their China alternatives AliPay and Wechat Pay - you should consider if you’re selling in China- make online payments super convenient for the customers.With their credit card information entering automatically, you only need a selling point -digital or physical- to let your customers pay.To implement in your website you need to follow each provider’s technical guidelines.Great news though! - most popular platforms make it easy to accept this payment method with just a click of a button, no coding required-

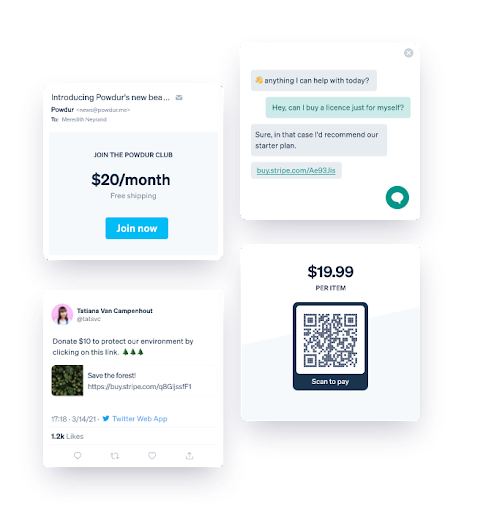

Payment Links

No introduction needed for this method of online payment. It’s self-explanatory after all. You can send invoices to your customers via email or any other form of online communication.

Then they can pay within a few clicks. Truly time-efficient way to accept payments without getting into too much trouble.

There is also further automation available , with invoicing sent to numerous customers as soon they sign up or fill their cart.

Some of the most popular ways to send payment links are:

Wrapping Up

“Decide what you want, and then act as if it were impossible to fail.”

With Covid-19 disrupting the complete commerce landscape and bringing to spotlight smart ways to conduct e-commerce, it’s now vital that your business is ready to handle this new demand.

Saying it differently, whoever is not able to meet customer’s demand completely and fairly, will inevitably go out of business -and payment methods are included-