In this article we’ll cover what recurring payment is and why you should prefer it for your business instead of one time payments or lifetime deals.

Why is a recurring payment

A recurring payment is when your business charges a customer for a product or service on a set schedule. For example $10 every month in order to continue using the product. The payment schedule can be anything but weekly, monthly and yearly are most common.

What is a recurring payment example?

Examples of recurring payments include services such as streaming music or video subscriptions, online services like web hosting or domain names, software licenses, online storage space, tenancy agreements etc. Here are a few subscription services you might recognize from your own bank account:

- Netflix

- Spotify

- Adobe Creative Suite

- Mobile Phone contract

- Internet provider

Advantages of using a recurring payment model for your SaaS business

A recurring payment model creates a steady income for your business. Instead of starting from zero every month and relying on new purchases to create cash flow for the business, subscription businesses get a guaranteed amount coming in each month (minus any churn from the previous month).

This steady income gives you the ability to plan and budget for future expenses. This is a great help for planning marketing and development budgets as you know pretty accurately how much will be coming in each month.

Customer Lifetime Value (the total income the business can bring from a single customer) is generally greater for recurring payment businesses than one off payments. This is great for customer retention as the customer has no action to take for their monthly payment which in turn is great for business owners.

When to use a Lifetime deal instead of recurring payments?

A lifetime deal means your customer pays once for a lifetime of access to your software or service. Lifetime deals can be a good way to generate cash and especially if you have a low Customer Lifetime Value. If your customers only stick around for a couple of months, they could be tempted by an offer that charges 6-12 months of monthly fees but gives them lifetime access.

Lifetime deals have some considerable flaws though. For one, you have to support your customers

What is the best way to set up recurring payments?

It is easy to accept payment recurring payments by using a payment processor such as Stripe (almost all payment processors can process recurring payments). If you have a website then you can accept recurring payments from your website using javascript and the Stripe API. If you are not a software developer you can use a no-code solution like PriceWell which makes the process as easy as copying and pasting a pricing table into your website.

Does PayPal do recurring payments?

Yes, PayPal accepts recurring payments, otherwise known as subscriptions. You need a PayPal business account. It’s often recommended to combine PayPal payments with a traditional payment source like credit card so maximise the conversion from visitor to customer. Stripe and PriceWell both support credit card and PayPal recurring payments.

How can customers stop recurring payments?

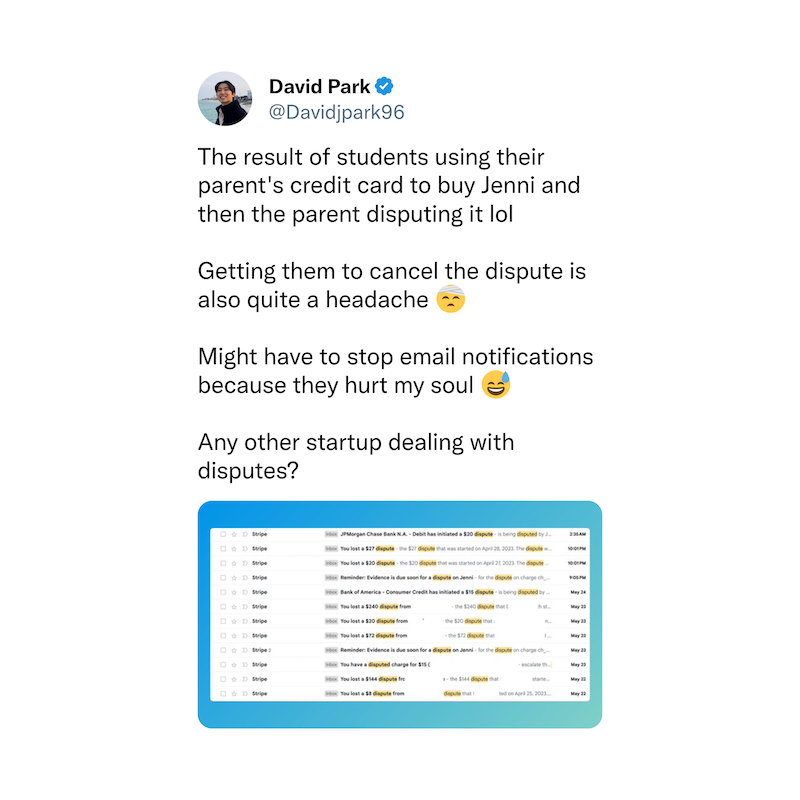

It’s important for you as a business to provide an easy, standardized way for your customers to cancel their subscription. Most SaaS applications have a “Subscription Management“ page which lets their customer manage their subscription. If you are using PriceWell, that’s as easy as adding a Customer Portal to your site. Alternatively consumers can contact their credit card provider and raise what is called a “chargeback”. This means flagging a payment as “not recognized”. A customer can charge back a payment if they don’t recognize where it came from or if they believe they have been charged by mistake. As a business, it’s important to avoid chargebacks. It costs both time and money to dispute a chargeback and the merchant is unlikely to win as they credit card companies are most often on the side of the consumer.

You have been warned.

How can I collect recurring payments without hiring a developer?

PriceWell is a no-code solution makes it super easy for small business owners to use Stripe (the worlds number one payment processor) to accept recurring payment. If you use a no-code website builder like Bubble, WordPress or Webflow for your website then PriceWell is the easiest way to get started with Stripe. There’s no coding required and our experts will help you every step of the way.