Don’t know how to handle SaaS Taxes in your business? Want to learn more?

We got you covered! You only need to follow these 4 steps.

- Register for Tax number/ Tax Permit

- Calculate and Collect Tax

- Record and Document Sales

- File Tax Returns

How do I handle SaaS taxes for my business?

Tax is a question troubling many SaaS founders across the globe and not without a reason.

As Software as a Service dominates everything around us and will grow 21.1% compound by 2023, more and more founders are coming to realize that this certain trend is followed by tax liabilities.

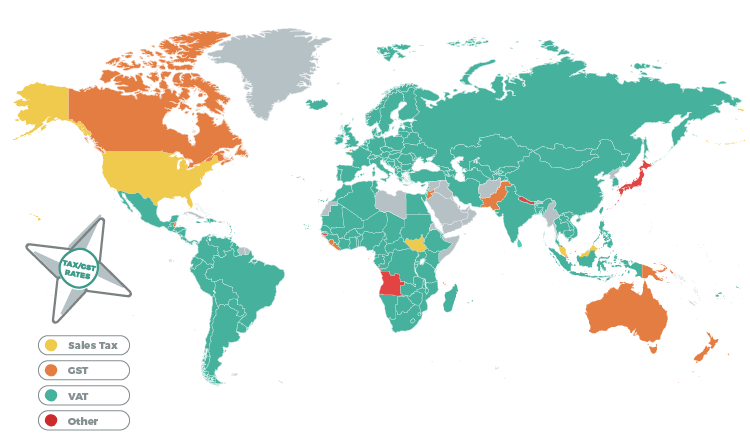

VAT, GST, and sales taxes are always relevant to your tech business and are the 3 main taxes that impact you. You also have several other taxes to worry about, varying on the location you’re selling and the local laws governing. It’s a complete mess, but we are here to make things a bit lighter.

But first, let’s break down each type of consumption tax:

- Sales Tax (United States)

- VAT (Value Added Tax - Europe)

- GST (Goods and Services Tax - Australia)

How much is SaaS Sales Tax in the United States?

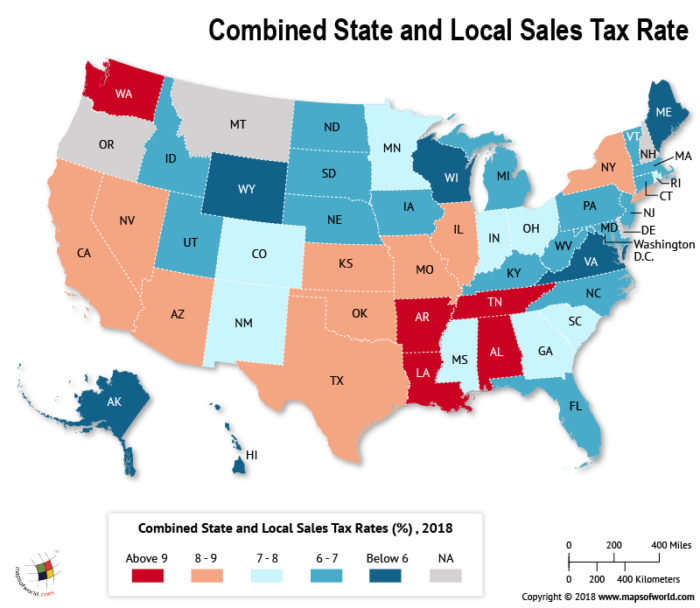

US Sales tax is a consumption tax (tax on the purchase of a good or service) that is charged only once, at the purchase of the final product by the consumer. Even though it is not a nationwide policy, as VAT and GST are in EU and Australia respectively, state and local authorities have the power to set their own tax laws and rates.

As you can understand, there are thousands of tax regulations, varying according to State and locality. A great resource on the details of US tax regulation can be found here, provided by Quaderno.

How much is SaaS VAT in Europe?

VAT is applied to all 27 EU member states and is charged to anywhere in the world your company might be, provided that you sell to European Union Customers!

So what exactly is the Value Added Tax for SaaS businesses?

It is again a consumption tax applied to all goods and services, whether in physical or digital form. The seller (your business) collects the VAT from the customer and pays a part of it or the whole amount back to the government.

Imagine your business being the “middleman” between the consumer and the government. It’s not your business’ money paying the VAT, rather than collecting and submitting the customer’s money to the government.

Therefore, it is super important to know when to charge VAT to your EU customers, because if you don’t, it will be your money paying for it to the government!

And bear in mind that in some EU countries VAT can reach up to 27%.

So pay a close look at how you handle VAT requirements!

A great resource on going down the VAT rabbit hole here

How much is SaaS GST in Australia?

Goods and Services Tax is one of the several consumption taxes around the world and the one chosen by the Australian and Indian Government in indirectly charging the consumer.

How GST works?

GST is levied at every step of production and it’s usually a flat rate percentage of the transaction. In India the rate for digital goods and services is at 18%, whereas in Australia it is at 10%.

Both in India and in Australia, a business pays GST for every good or service that helps them create the end-product. Accordingly, when the finished product (good or service) is being sold, the buyer pays the GST to the business. The particular difference lies to the fact that the business must pay the tax forward to the government when taxes are due.

On a later stage, the business is refunded for all GST paid before, during the “production” process. Effectively, this means that everyone is refunded through tax credits (returns), except the final buyer (consumer). Again we see the tax “middleman” phenomenon between the government and the consumer played by the business.

What about Digital Products in specific?

In Australia, GST laws are split between B2C and B2B sales.

B2C

There is a threshold of A$75,000/year, that if your business passes, is required to register for GST in Australia. If your business is selling more than A$75,000 in yearly sales to private (non-business) customers, then you need to:

- Register for GST in Australia

- Charge 10% on every B2C Sale

- File your proceeds to the Australian Tax Organization (ATO)

Under that threshold, and you have one less thing to worry about, yet!

B2B

Selling exclusively B2B as an overseas business , then there is nothing to worry about GST-wise, since your sales are under the reserve-change mechanism. In short, your Australian Business Partners (Buyers) are actually the ones handling GST for you.

However, if you are selling a mix of B2B and B2C services, then the A$75,000 threshold rule applies to your business.

Even though we provide the context explaining Sales Taxes, the initial question still remains.

How do I handle SaaS taxes?

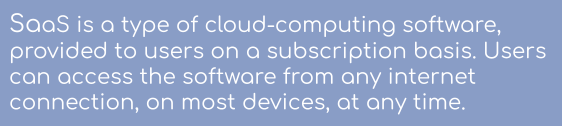

A SaaS product is inherently different from a typical digital good that you buy on the internet, and it’s taxed differently, too. The definition of a SaaS:

In every region you might be selling your product you have to look up for the tax thresholds. Effectively, if you’re underselling the tax threshold you are exempt from the tax requirements. ADD TAX THRESHOLDS

There are some countries as you can see that do not have tax thresholds, therefore by the time of your first sale you need to be able to do the following:

- Register for Tax number/ Tax Permit

- Calculate and Collect Tax

- Record and Document Sales

- File Tax Returns

Register for a Tax Number for your SaaS

EU Tax Numbers for SaaS

Your business needs to have a VAT number to comply with EU VAT laws. It’s quite easy for both European and non-European businesses to get an EU VAT number.

The European Union has created the “VAT One-Stop Shop” or OSS, an excellent scheme for managing all member state’s through one centralized system. You register with the member state you’re located in, or if not located in the EU, you can choose any EU country you like (preferably Ireland, since the language is English).

You register through the country’s VAT OSS online portal, and that country will serve as your VAT homebase.

VAT exemption in EU

You are not required to register in the VAT OSS if your business meets the following criteria:

You are EU Business and you have less than €10,000 in cross-border B2C sales in other EU Countries

As soon as you cross the €10,000 you are obliged to register for VAT OSS and follow the rules.

U.S Tax Numbers for SaaS

In the U.S. you need to get a tax permit in each state you have nexus (the connection between a seller and a state that requires the seller to register then collect and remit sales tax in the state). Beginning collecting taxes without a tax permit can be considered tax fraud by some states.

Thankfully, many states allow you to register online with the Department of Revenue. Usually you will receive your sales tax permit number instantly upon registering, or maximum within 10 days.

An Important Detail: You can register in all 24 SSUTA streamlined states at once, with one registration process, but this might end up burdening you with unnecessary tax liabilities. You would probably end up liable for tax in some states even though you don’t have nexus there, simply due to registration.

In other places around the world

Most other countries offer correspondingly some kind of simplified registration for foreign businesses. Either by email or by an online portal, you can register for VAT/GST and receive your tax number within a couple of days, with information about how to proceed.

A few countries might still need you to hire a local tax representative to handle the whole process, usually assigned by the government.

In any way, you need to continue complying each year with the tax requirements, even if you don’t hit the threshold again the following year. (on condition that you hit it at least once)

Calculate and Collect SaaS Taxes

Thankfully this is the part where PriceWell with Stripe Tax comes to the rescue. There is no need to get into specific regional and country requirements to find where your customer tax applies. We do it for you automatically by requesting your customer’s billing address.

The automatic process works as follows:

Stripe Tax in the EU

The problem in the EU and the general rule is that you must identify where the customer comes from. (If comes from Greece you must apply the Greek VAT rate to the sale)

The key and thus the problem is to determine where exactly they are coming from. That’s where the pain point lies and PriceWell can help you deal with it.

The standard procedure is that you need to collect two pieces of customer location evidence. Not calculating and collecting the right amount of tax and your business will pay the difference!

The pieces of evidence are:

- Billing Address

- Location of customer’s bank

- Country issued the credit card

- IP address of the device that customer uses

- Country of SIM (in the case customer uses mobile device)

Note for European SaaS businesses selling in the EU

If you are a European SaaS business, you always charge VAT in your home country. You charge VAT on every sale of digital goods.

That’s convenient! (The last one you will find in the tax code.)

Stripe Tax in the US

- Confirm your buyer’s location.

- Calculate the tax rate based on the state law. Check If the state has “origin-based” or “destination-based” tax rates.

- Check all the tax rates that apply. There could be more levels than just a statewide sales tax! There may also be a county, city, or other local sales tax rate.

Stripe Tax in other Countries

The process is a bit more straightforward because individual countries have a single national tax rate. As for how to collect it, a few of the steps remain the same as above.

- Customer Verification (Country-wise)

- Add the correct tax amount and collect it at the point of sale.

Keeping up with the tax rates around the world can be a huge hassle. So gearing up with the right tools can save you tons of time and money.

Check out PriceWell with Stripe Tax or any other stack of automatic tax calculation and collection tools.

Record and Document Taxes

Here comes the fun part! After calculating and collecting the taxes on top of every sale, you will need to issue the necessary credentials (receipts or invoices) to comply with tax laws.

And believe me, there’s no thing governments love more than proper documentation and back ups. But bear in mind that tax receipts or invoices are also the required documents for claiming any tax deductions when you file.

Ideally you would like to have a template of invoice or receipt to send to your customers, that would work for any country.

An ideal Invoice should include:

- A unique invoice number.

- Your tax registration number

- Your company’s name and address

- The company name and address of the customer.

- A description of the services.

- The date of sale.

- The date of the invoice issuance (can be the same).

- The amount of the individual services to be paid.

- Amount of sales taxes (VAT, GST) to be paid

File Tax Returns for SaaS

Normally, this procedure is handled by a CPA, where you handle the invoices/receipt docs for the quarter and files them under the correct markment and jurisdiction.

In the U.S. you need to file tax returns for each state separately, at different intervals, therefore it is quite troublesome to keep track of all deadlines and procedures. A CPA in that sense, can let you off much trouble. Alternatively, there are many tools that can help you file tax returns such as TurboTax and H&R Block

Thankfully, in the EU there is the VAT OSS, where you need to file returns every quarter. Rules are much more uniform, with just 4 fillings each year (1 every quarter). From the last day of each quarter, you have 20 days to file and pay. The deadlines are strict and you might be due to a fine if missed.

Deadlines:

- 20 April, for the first quarter ending March 31

- 20 July, for the second quarter ending June 30

- 20 October, for the third quarter ending September 30

- 20 January, for the fourth quarter ending December 31

In theory, the European procedure might seem much more straightforward than any other, but it also hides some tricks.

For example, if you made any sales in a different currency(in the Danish Krone, but your OSS uses the Euro), you need to convert those amounts to the official currency of your OSS.

A great additional resource for VAT filling tricks here

Last Remarks

Handling SaaS taxes is tricky, especially if your client base is international and you need to keep track of every digital tax law around the world.

Having knowledge on the taxes as a business owner and tax compliance regulation is important, but no one should have to manage all those tedious and tiring steps alone.

A bookkeeper or a CPA can be a good idea, but some parts of taxing can be automated, resulting in large savings of time, money and effort.

PriceWell is a tool that can help small SaaS businesses and creators collect, manage and automate their tax procedures up to the filling part.

In detail PriceWell can do all the following:

- Calculate the right amount of tax to charge each customer, right on your checkout page.

- Collect and store the customer location evidence from every sale.

- Create tax receipts and invoices in multiple languages and currencies.

- Send tax receipts and invoices automatically.